What is described below are adjustments for the tax year 2025, and these changes will be applied to your income tax return starting tax season 2026. The IRS has taken this chance to address the inflation through many changes in its tax provisions. Here are some noticeable changes that draw the greatest interest to most taxpayers as following:

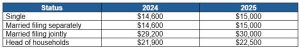

Standard deductions.

Each category’s standard deduction will be increased.

Marginal rates.

The tax rate remains unchanged but the income threshold for individual single taxpayers and married couples filing jointly will be increased to slightly ease the tax burden.

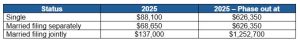

Alternative minimum tax exemption amounts.

There is an adjustment for Single individual taxpayers as the amount will be increased along with Married filing jointly.

Earned income tax credits (EITC)

For the tax year 2025, any qualifying taxpayers with three (3) or more qualifying children will get a maximum EITC of $8,046. The revenue procedure also contains an updated table including maximum EITC amount for other categories, income thresholds and phase-outs.

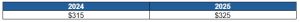

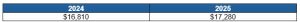

Qualified transportation fringe benefit.

The monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking will increase by $10.

Health flexible spending cafeteria plans.

For the taxable years beginning in 2025, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements is $3,300. For cafeteria plans that permit the carryover of unused amounts, the maximum carryover amount is $660.

Medical savings accounts.

For a self-only coverage plan, participants must have an annual minimum deductible of $2,850, but not more than $4,300. The maximum out-of-pocket expense amount is $5,700 for taxable year 2025.

For a family coverage plan, the annual minimum deductible is $5,700, but not more than $8,550. The out-of-pocket expense for family coverage limit is $10,500 for tax year 2025.

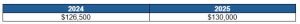

Foreign earned income exclusion.

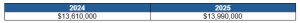

For tax year 2025, the foreign earned income exclusion increases by $3,500.

Estate tax credits.

Basic exclusion of estate tax for the year of 2025 increases by $380,000.

Annual exclusion for gifts

Adoption credits.

For tax year 2025, there is an increase of $470 for the maximum credit allowed for an adoption of a child with special needs is the amount of qualified adoption expenses.

Unchanged for tax year 2025

Beside those changes, there are some items that were indexed for inflation but not changed for the year of 2025.

- Personal exemptions for tax year 2025 remain at 0.

- Itemized deductions. There is no limitation on itemized deductions for tax year 2025.

- Lifetime learning credits. There is no change in this item, and the Lifetime Learning Credit is still phased out for taxpayers with modified adjusted gross income in excess of $80,000 ($160,000 for joint returns).